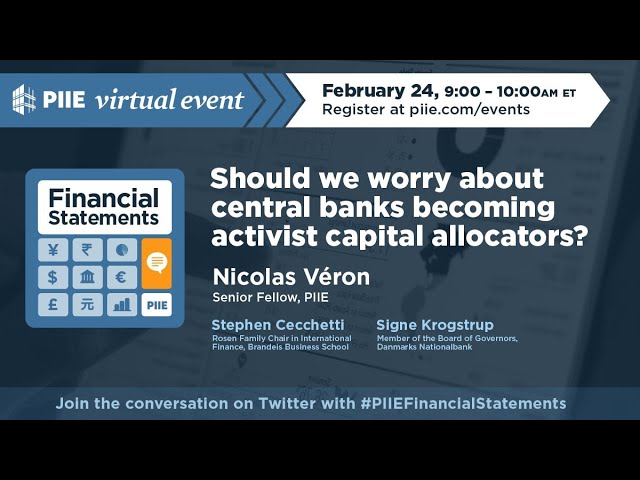

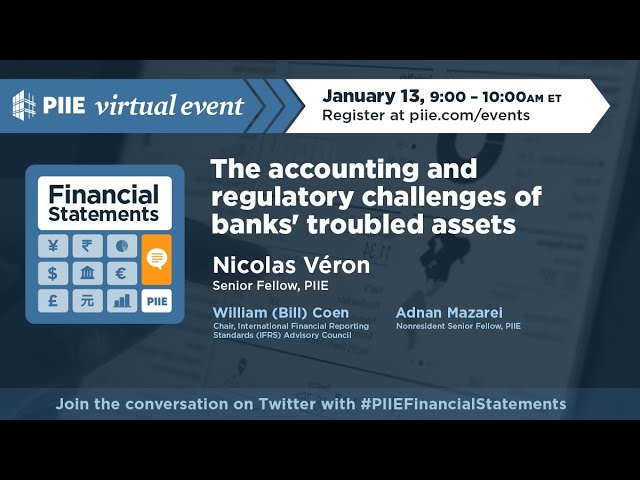

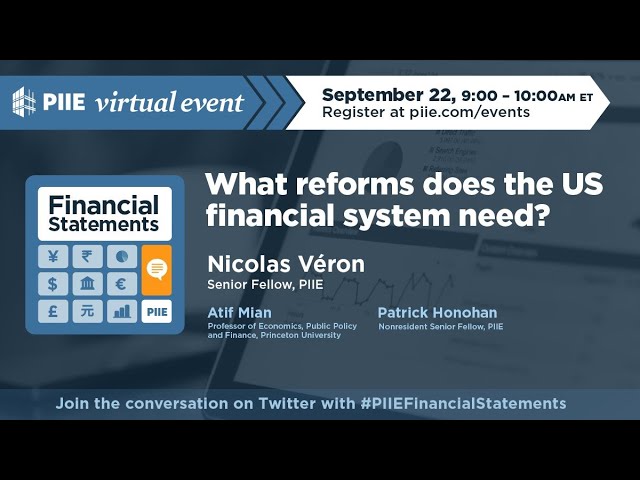

Financial Statements is a biweekly virtual event series hosted by Nicolas Véron that explores changes in the world of finance, encompassing themes of financial services regulation, corporate finance and governance, systemic fragility and crises, and structural changes driving business and policy trends in the financial sector.